Simplifying technical banking procedures through interactive learning

CLIENT

Georgia’s Own Credit Union

ROLES

Instructional Designer

eLearning Developer

Project Manager

LEARNING SOLUTIONS

Self-guided course

Video demonstrations

Software simulations

Learning assessment

On-the-job reference guide

TOOLS

Articulate Storyline 360

Camtasia

Microsoft Word

Self-paced learning experience through step-by-step digital on-the-job training

CHALLENGE

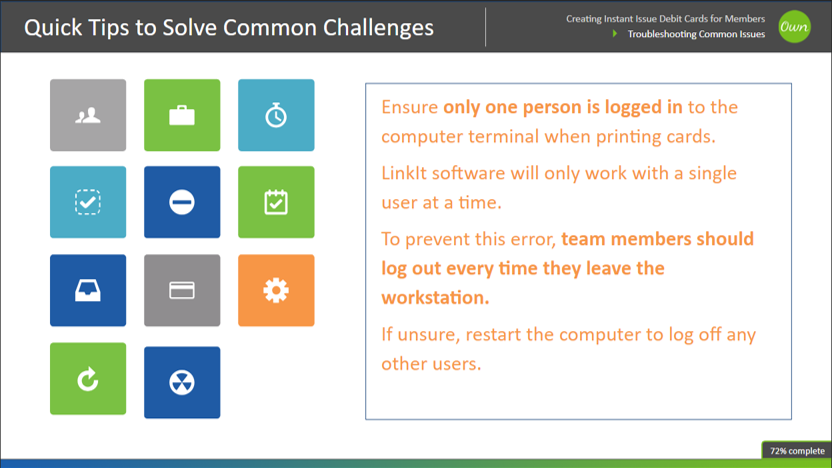

All branch employees and managers needed to perform standardized procedures for issuing instant debit cards using both banking management software and physical card printing equipment.

The training program had to ensure consistency, accuracy, and compliance across multiple locations—while remaining engaging and accessible to busy frontline staff with varying levels of technical proficiency.

In partnership with the client’s subject matter experts, I designed and developed a comprehensive blended eLearning program that combined visual demonstrations, practice opportunities, and quick-reference tools to reinforce procedural knowledge.

Key actions included:

Conducted audience and task analyses to define course objectives and learning outcomes.

Developed detailed scripts, storyboards, and assessments aligned with system workflows.

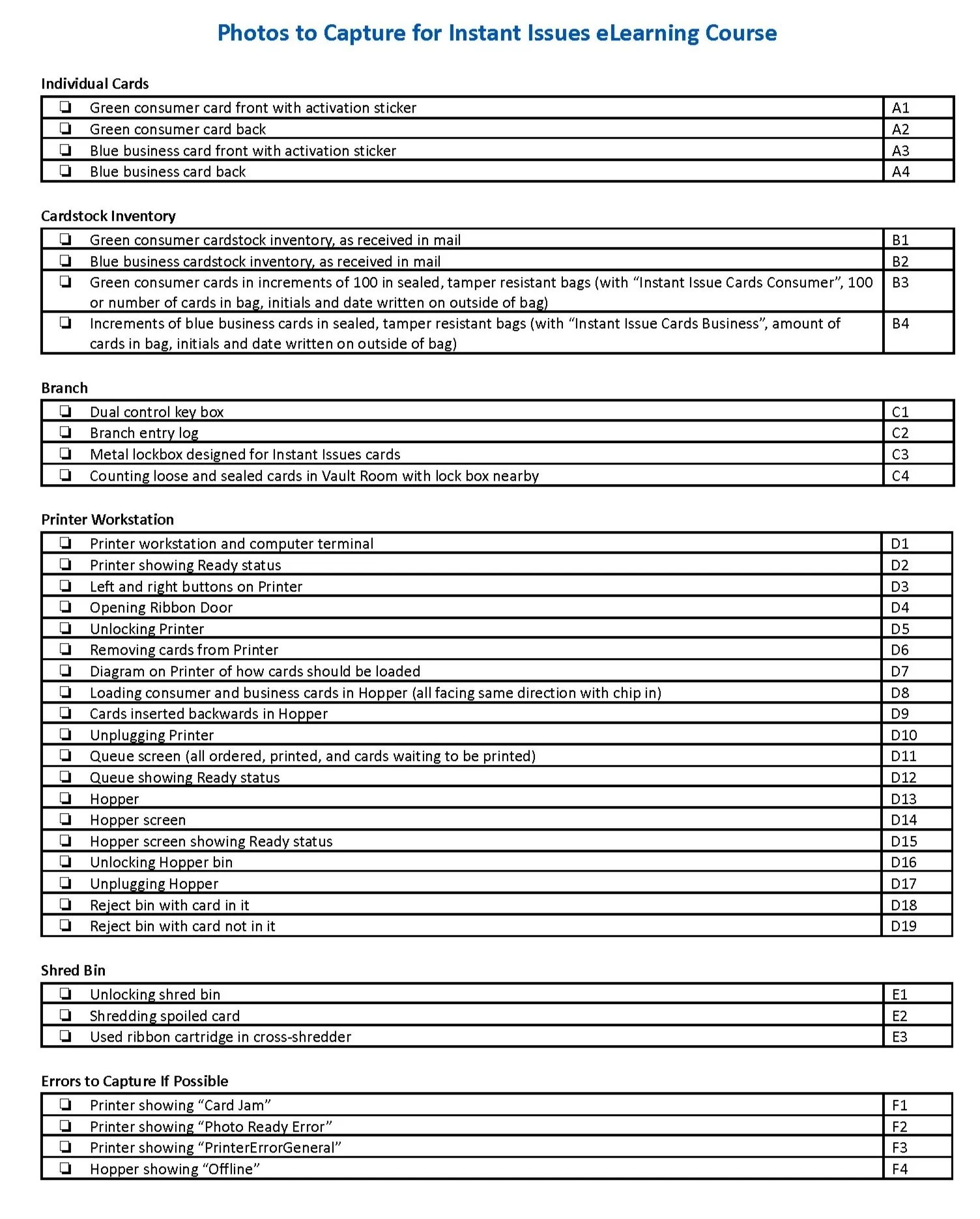

Collaborated remotely with SMEs to capture authentic video and photo assets of both the software and the physical workstation process.

Built software simulations for guided practice and video walkthroughs for quick visual reinforcement.

Created an on-the-job reference guide outlining every step of the process for easy use during live transactions.

Ensured all materials aligned with the client’s brand standards and eLearning templates.

DELIVERABLES

Self-guided eLearning course with interactive simulations and video demonstrations

Detailed task procedures, scripts, and storyboards

Step-by-step on-the-job reference guide

Assessment for procedural and compliance verification

Video and photo asset library aligned with system workflows

RESULTS

Standardized branch-level execution of instant debit card issuance procedures.

Reduced employee error and improved confidence through guided practice and just-in-time references.

Enabled faster onboarding for new employees with consistent, accessible learning content.

Provided evergreen digital training assets that reduced the need for repeated in-person instruction.